United States Military Pay is money paid. 2005, 2006, 2008, and 2009 approved the pay raise. View 2016 Military Reserve Drill Pay Chart for all. Military Pay; Military Pay Charts; Basic Allowance for Housing (BAH) Allowances. 2012 Active Duty Military Pay Chart 2012 Guard and Reserve Drill Pay Charts.

Military Pay and BAH (Basic Allowance for Housing) Archive. Expert Answers are Ready. In doing my research comparing a VA loan versus a conventional loan, it appears that if you put 2.

I used by VA home loan eligibility on a home purchase back in the 8. I paid it off years ago.

- 2008 Military Pay Scale for US Army. 2008 Basic Pay schedule per the United States President's Defense Budget approved the prior year. Below was the active 2008.

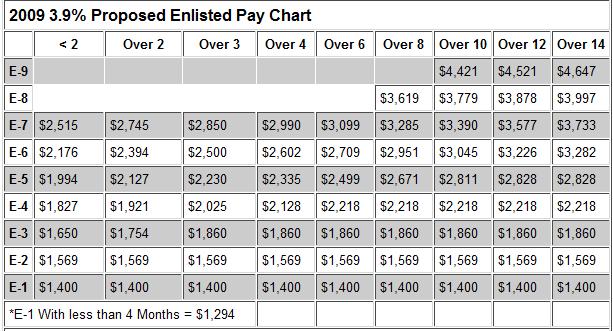

- Posted on: January 2, 2015. 2009 Military Pay Chart (pdf) 2008 Military Pay Chart (pdf) For additional information.

- Military Pay Charts : The pay. 2006 Military Pay Charts The 2006 military basic pay reflects an across.

- 2016 military pay chart for Active Duty and for those serving in the Guard or as a drilling reservist. Navy Cyberspace is the most.

- September 2008 Report on Pay Comparison Study. Page 2 of 43 www.haygroup.com Contents Page 1. Overview of Hay Guide Chart Method 35 2.

- Chart showcasing the pay scale for the U.S. Past charts are available on the Military Pay Chart index.

- BASIC PAY—EFFECTIVE JANUARY 1, 2013. Pay Grade 2 or less Over 2 Over 3 Over 4 Over 6 Over 8 Over 10 Over 12 Over 14 Over 16 Over 18.

I want to purchase another home.. I am active duty military and government housing is not available at my base. Can a VA lender can count my BAH income..

United States military pay - Wikipedia, the free encyclopedia. United States Military Pay is money paid to members in the United States Armed Forces. The amount of pay may vary by the member's rank, time in the military, location duty assignment, and by some special skills the member may have. Pay versus Allowance. Typically, pay is money which is based upon remuneration for employment, while allowance is money necessary for the efficient performance of duty. Generally speaking, pay is income, while allowances are reimbursements. In the landmark case Jones v.

The United States, the Court of Claims decided that military allowances are not . If the 1st or 1. 5th of the month falls on a Saturday the member will be paid the weekday before. If it falls on a Sunday, they get paid on the following Monday.

The monthly pay statement is known as a Leave and Earnings Statement or LES, which is usually available near the end of each month. The money is directly deposited into a member's personal banking account. The payment on the 1. Basic Pay is the same for all the services. Title 3. 7 U. S. C. Employment Cost Index (ECI).

The Fiscal Year 2. President. However, Congress, in financial years 2. ECI increase plus 0. The 2. 00. 7 pay raise was equal to the ECI.

In addition to across- the- board pay raises for all military personnel, mid- year, targeted pay raises (targeted at specific grades and longevity) have also been authorized over the past several years. Reserve/National Guard .

This allowance is based in the historic origins of the military in which the military provided room and board (or rations) as part of a member's pay. This allowance is not intended to offset the costs of meals for family members. Beginning on January 1, 2. BAS, but paid for their meals (including those provided by the government). It was the culmination of the BAS Reform transition period.

Because BAS is intended to provide meals for the service member, its level is linked to the price of food. Therefore, each year it is adjusted based upon the increase of the price of food as measured by the USDA food cost index. This is why the increase to BAS will not necessarily be the same percentage as that applied to the increase in the pay table, as annual pay raises are linked to the increase of private sector wages. As of 2. 01. 0, enlisted members receive $3. Enlisted BAS II. Enlisted members on duty at a permanent station and assigned to single (unaccompanied) Government quarters, which do not have adequate food storage or preparation facilities, and where a government mess is not available and the government cannot otherwise make meals available, may be entitled to BAS II. The rate for BAS II is fixed at twice the rate for standard enlisted BAS.

Effective February 1. Navy authorized the payment of BAS II. Effective October 1, 2. Air Force authorized payment of BAS II to members at specific locations. Clothing allowance: Comes to most members on an annual basis to buy and replace required uniforms. The amount varies by service and rank. Code dictates a rather complex equation for military pay raises, based on the Employment Cost Index, a measure compiled by the Bureau of Labor Statistics to track the costs of labor for businesses.

Military pay increases by . For example, because the ECI increased 1. The raise is unusually low . Congress can also vote to change the president's proposed decrease or increase. For the 2. 01. 1 budget, the House Armed Services Committee suggested boosting the 1.

But Defense personnel officials resisted, saying they would rather that money be used for other programs that benefit military families. After an 1. 1- year string of increases that slightly exceeded average private sector annual raises, Army Deputy Chief of Staff for Personnel Lt.

Thomas Bostick said that, . Monthly pay varies by rank and flight experience.

Jump Pay: For military parachutists who meet the requirements. Regular is $1. 50 per month, HALO is $2.

Foreign Language Proficiency Pay. Historic pay raise chart. The rate varies by the location.

Hostile Fire Pay/Imminent Danger Pay: Monthly pay that appears on the LES as . Sometimes referred to as Combat Pay. Other examples are parachuting and scuba diving. Family Separation Allowance: Money paid when required to be away from dependents (spouse, minor children, or other designated individuals) due to military duties. Technically it is intended to offset the costs associated with being separated such as landscaping, car maintenance, occasional child care, phone calls and mail, rather than being a monetary compensation for the emotional effect of the distant spouse.

Appears on the LES as . The amount of COLA varies by country and possibly location in a country. The amount of COLA also varies by rank, number of dependents (in the location) as well as living situation (off base may receive more than on base) and the exchange rate between the US dollar and the local currency. COLA is meant to provide a member overseas and a CONUS the same spending power, so COLA may go up and down as prices in either country change. See also. United States Office of Personnel Management. Bureau of Labor Statistics. American Forces Press Service.